Sales Tax Registration Texas

Every entity engaging in trade of products, services have to register under Sales Tax in Texas. Texas has both sales tax and use tax on taxable products, services and lease.

One can register online on Texas tax portal or offline with paper application. To register online social security number is compulsory. You cannot make online application unless you have SSN.

Who should get Sales Tax and Use Tax permit in Texas?

Every person engaged in business or sell or lease tangible personal property or sell taxable services in state of california.

You need to register and obtain sales tax and use tax permit if you are:

- Running a business in Texas, or

- Leasing or selling tangible personal property in Texas, or

- Providing taxable services in Texas

Documents for sales tax registration in Texas

To apply for sales tax permit, your age must be at least 18 years. Social Security number is must and if you do not have SSN, then you need to apply with form AP-201.

Here are the details you must have to obtain sales tax permit.

- Social Security number

- Partnership Social Security numbers or federal employer's identification numbers for each partner

- Texas corporation's file number from the Texas Secretary of State.

- Social Security number for each officer or director of a corporation

- North American Industrial Classification System (NAICS) code required for all businesses.

Procedure to get sales tax permit in Texas

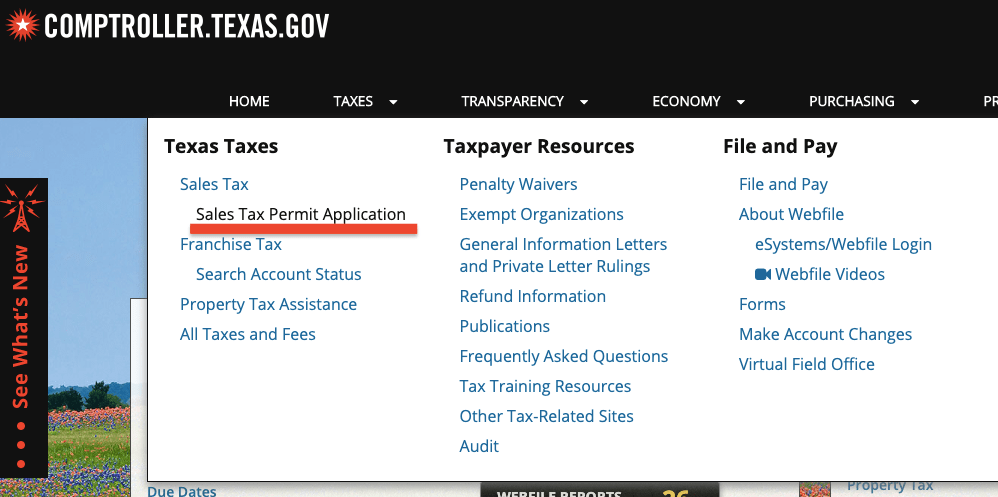

- Visit comptroller.texas.gov

- Click on Taxes menu

- Click on Sales Tax Permit Application

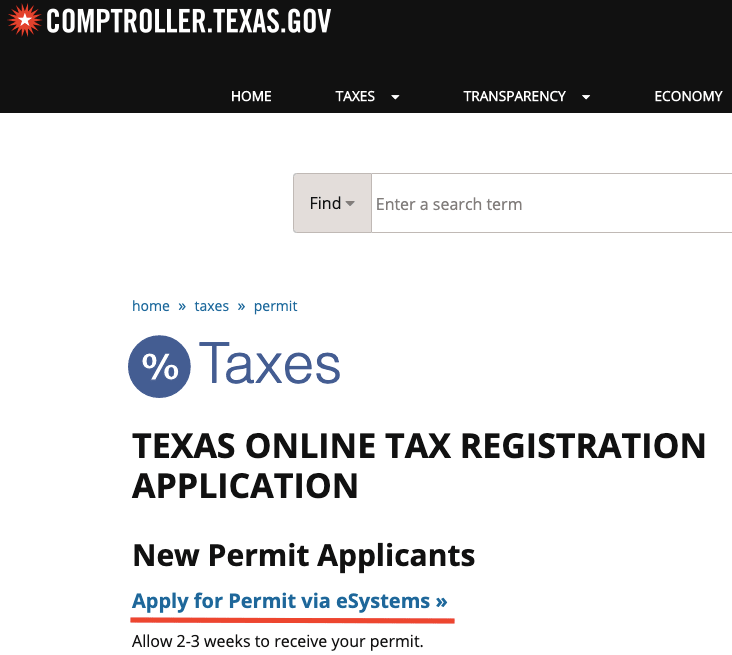

- Click on Apply for Permit via eSystems

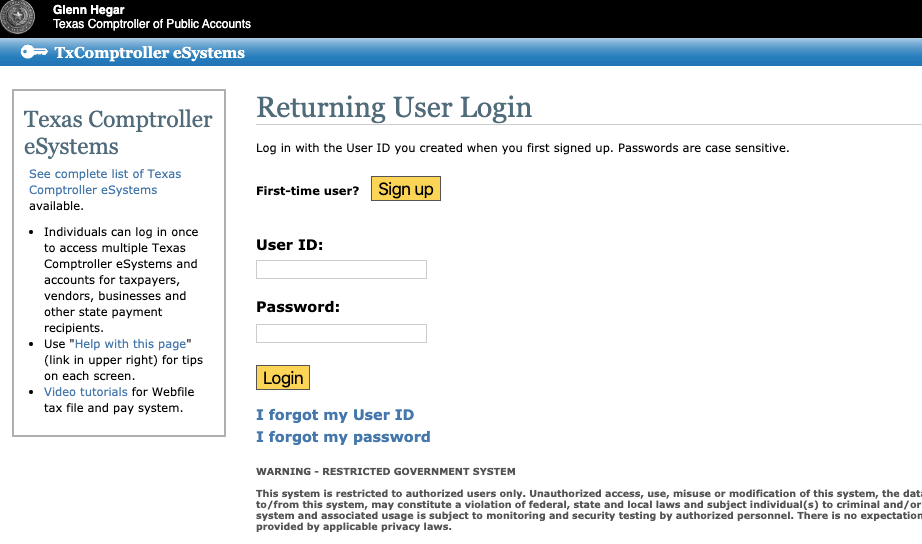

- Click on Signup

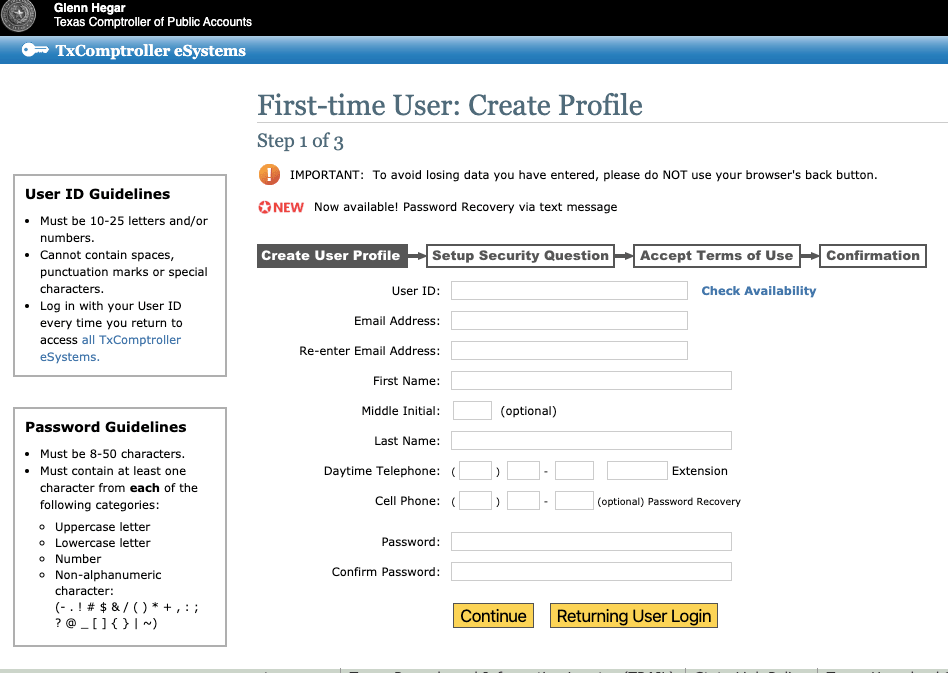

- Fill the details and create an account

- Login and complete registration procedure

First step in getting sales tax permit in Texas is to visit CPA website. On website in Taxes menu click on Sales Tax Permit Application.

You will be taken to next, screen and here click on Apply for Permit via eSystems.

Clicking on above link will take you to login page. If you are a new user, you need to first sign up on comptroller website.

Click on Signup button.

You will be taken to registration page. Here you need to fill detail and proceed for account registration.

After creating your account, you can login to your account and proceed with filing of registration form.

Registration procedure is completely online and in some cases permit is issued within same day. However, it may take few days to get a final sales tax permit.

Sales Tax compliance

After getting sales tax permit, you have to:

- File monthly/quarterly/Annual returns

- Remit payment to government

- Maintain documents

Non-payment of taxes or non -filing can result in heavy penalties including imprisonment.

Sales Tax Rates in Texas

| State Rate | 6.25% |

| County Rate | 0.50% |

| City Rate | 1.37% |

| Special Rate | 0.91% |

| Combined Rate | 7.63% |

Check Sales Tax Calculator and rates in Texas.

Updated: March 31, 2020

Related Posts

Sales Tax in USAEvery economy to sustain development projects needs sources of funding. Sales tax worldwide has been major contributor for government funding. I...

Sales Tax Registration in Ohio

Every retailer before selling any taxable product has to compulsory take Sales tax registration in Ohio state. Person having nexus in Ohio state an...

Sales Tax Registration in Washington

You will need Business License registration or sales and use tax registration to run your business in Washington state. Business license can be ...

Sales Tax Registration process in New York

Every person making taxable sales has to obtain Certificate of Authority. Certificate of Authority is registration certificate issued by New York t...

Sales Tax Registration in Florida

Florida collects both Sales Tax and Use Tax. Sales tax is charged on any sale, storage or rental, unless the product is exempted from tax. Use t...

Sales Tax Registration in California

Sales and Use tax are applicable in state of California. If you are seller here or have nexus then you are required to have sales tax per...

Tax system in United States of America

In world 2 types of taxes are levied on citizens, Direct Taxes and Indirect Taxes. Impact of direct tax is born by tax payer and indirect taxes are...