Sales Tax Registration in Washington

You will need Business License registration or sales and use tax registration to run your business in Washington state.

Business license can be obtained online. You will get your business license after application is filed. A single business license will enable you to apply for multiple services in state, for example city and state endorsements, UBI number etc.

Who should apply for business license?

- You are selling taxable products within state of Washington.

- If you need city and state endorsements.

- Doing business other than legal name

- Business is required to pay taxes or fee

These are some of cases where you need business license. Once business license is obtained, you can register for sales tax and start collecting sales tax from customers and remit to government.

Cost of Sales Tax License in Washington state

Cost for obtaining only sales tax license is nil but you will have to apply for many other license, a single business license can cover these different licenses. Cost to apply for business license is $19.

Further if you apply for license through a consultant, consultancy fee may be extra.

Procedure to obtain Business License in Washington

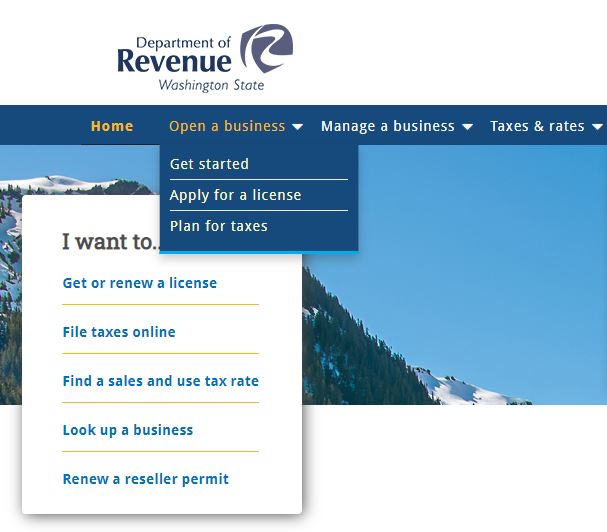

- Go to Washington state revenue portal

- Click on Open a Business menu

- Click on Apply for a license

- Launch Business Licensing Wizard

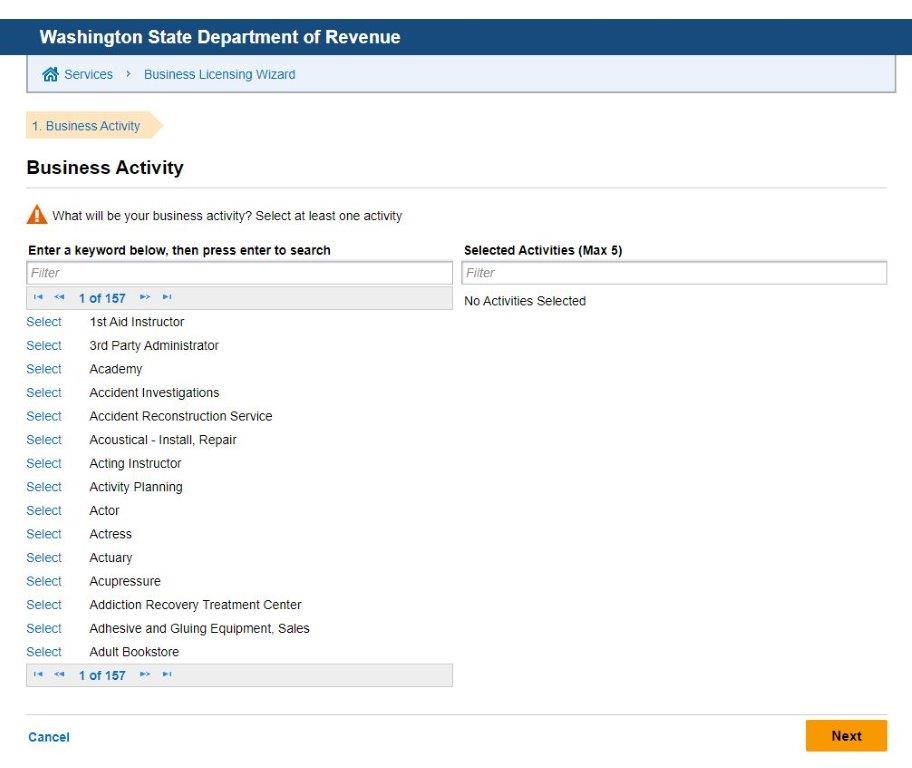

- Complete survey to understand license you require

At the end you will be provided with list of licenses you required. You need to provide following details to fill questionnaire.

- Business Activity

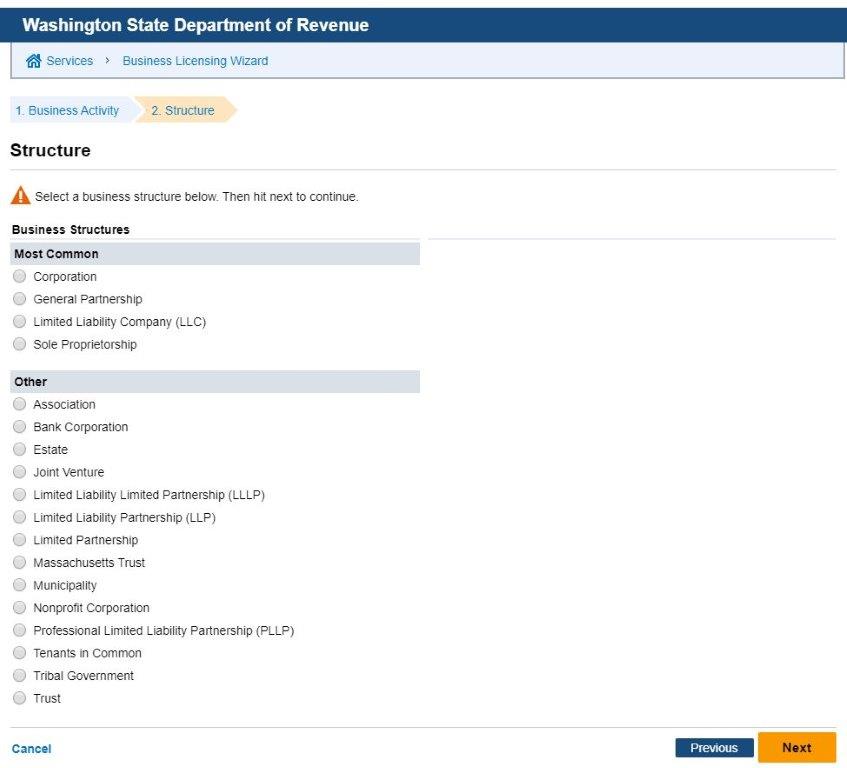

- Structure

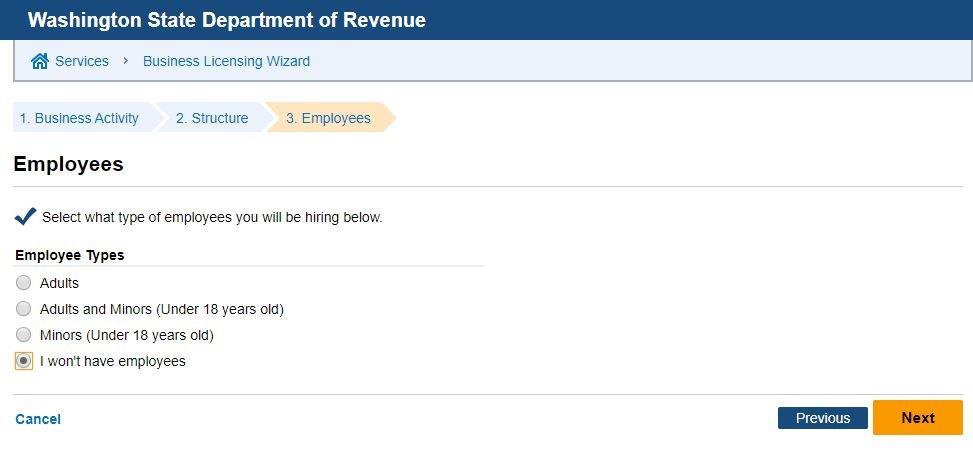

- Employees

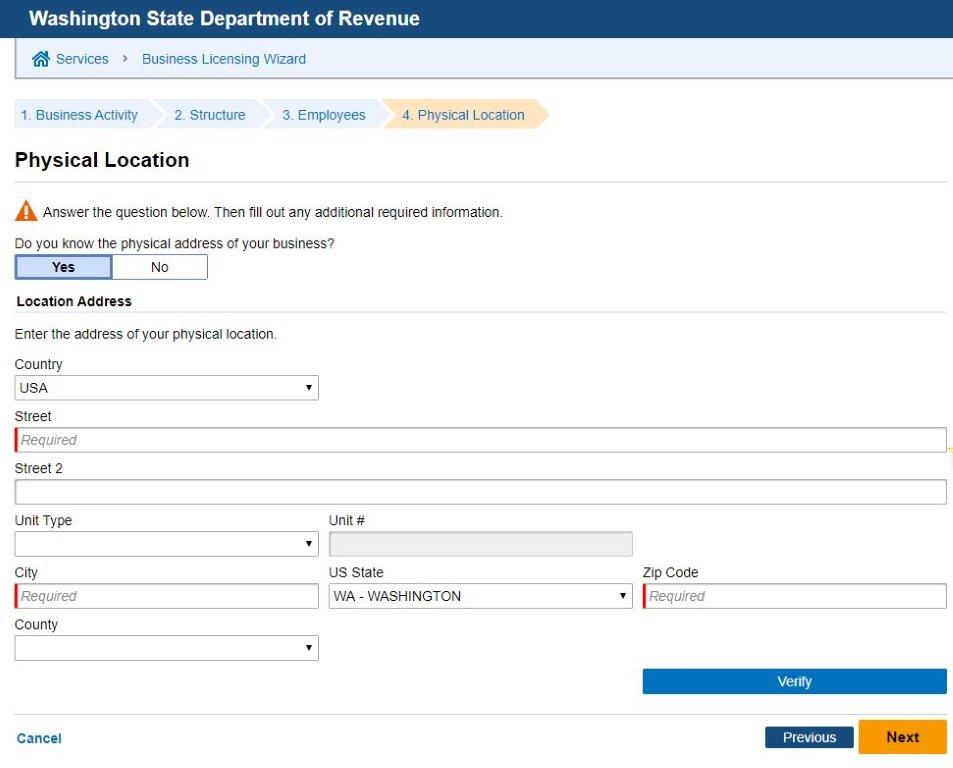

- Physical Location

- Other cities

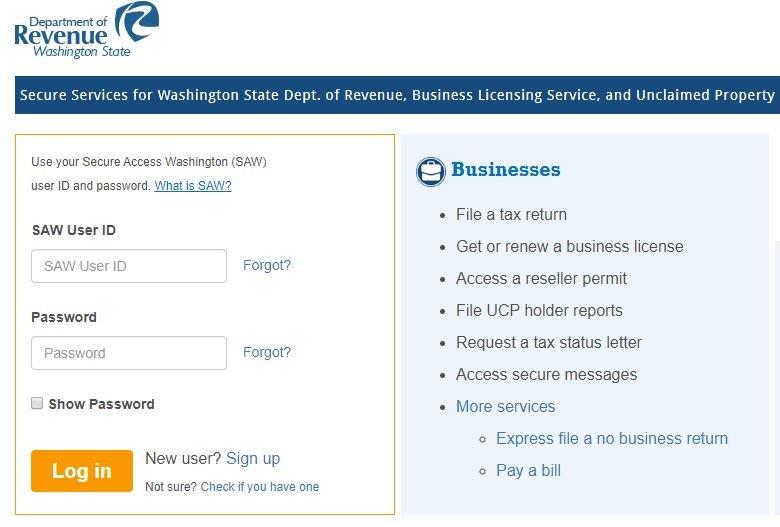

If you are already aware of licenses you need, you can also directly visit state tax login page and create account.

First step is to visit Washington state tax portal and Click on Apply for a license

On next page instruction are provided. Click on Business Licensing Wizard

Business Licensing Wizard will open. Here you need to answer questionnaire to know about required licenses.

First you have to select your business activity and next is Structure.

After selecting business structure proceed to Employees section. If you wish to appoint people under employment select the option here.

After selecting employee option, next is regarding physical location of business. If you have location within Washington state, you need to provide address.

After filling your address, you can also include additional places of business within state (if any). After submitting the form you will be provided list of applicable registrations.

You can apply for business license by clicking on Apply Now button. Once you click on Apply Now button, you will be taken to login/sign up page of state revenue website.

If you are not already registered on website, you can create a new account.

Login to your account and you can apply for a business license. Wish you luck for your business!!!!

Sales Tax Rates in Washington

| State Rate | 6.50% |

| County Rate | 1.56% |

| City Rate | 2.68% |

| Special Rate | 2.41% |

| Combined Rate | 8.70% |

Check Sales Tax calculator and rates in Washington.

Updated: March 31, 2020

Related Posts

Sales Tax in USAEvery economy to sustain development projects needs sources of funding. Sales tax worldwide has been major contributor for government funding. I...

Sales Tax Registration in Ohio

Every retailer before selling any taxable product has to compulsory take Sales tax registration in Ohio state. Person having nexus in Ohio state an...

Sales Tax Registration process in New York

Every person making taxable sales has to obtain Certificate of Authority. Certificate of Authority is registration certificate issued by New York t...

Sales Tax Registration in Florida

Florida collects both Sales Tax and Use Tax. Sales tax is charged on any sale, storage or rental, unless the product is exempted from tax. Use t...

Sales Tax Registration Texas

Every entity engaging in trade of products, services have to register under Sales Tax in Texas. Texas has both sales tax and use tax on taxable pro...

Sales Tax Registration in California

Sales and Use tax are applicable in state of California. If you are seller here or have nexus then you are required to have sales tax per...

Tax system in United States of America

In world 2 types of taxes are levied on citizens, Direct Taxes and Indirect Taxes. Impact of direct tax is born by tax payer and indirect taxes are...