Sales Tax Registration in California

Sales and Use tax are applicable in state of California. If you are seller here or have nexus then you are required to have sales tax permit.

Sales tax is charged on retail sales of taxable products, registration is not required for sale of exempted products. Use tax is charged on use, storage or consumption of products where sales tax is not applicable.

Registration requirement under Sales and Use Tax in California

Any retailer whether a natural person (individual), corporation, partnership firm or limited liability company must get registered with California Department of Tax and Fee Administration (CDTFA) if they deal in taxable products.

If you are liable for registration but have not registered, authorities can issue notice and register your business. Authorities will collect sales tax along with penalties.

Registration procedure with CDTFA for sales and use tax permit

To register with California Department of Tax and Fee Administration (CDTFA), you need to visit CDTFA portal. Registration procedure is completely online and one can complete it by visiting CDTFA portal. Registration is one time activity if you are not opting for temporary registration. No need to renew your permit every year.

Complete process to get sales tax permit in California is:

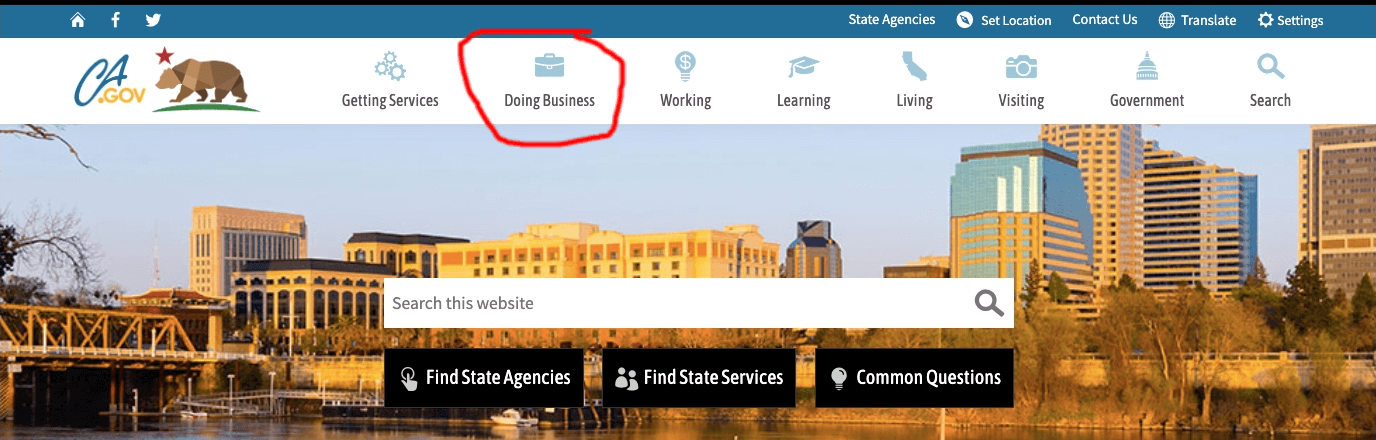

- Visit ca.gov portal

- Click on Doing business link

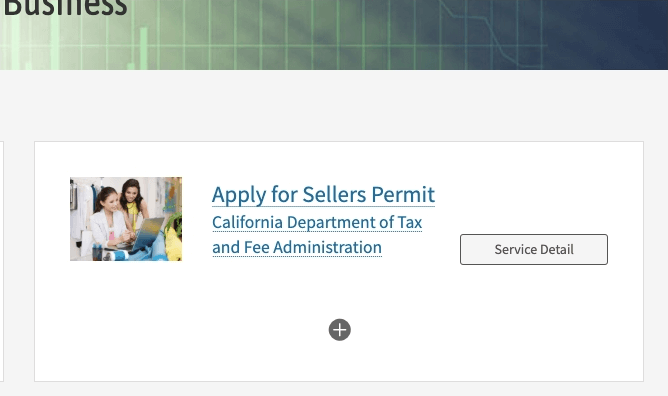

- Click on Apply for Sellers Permit

- Click on Launch Service

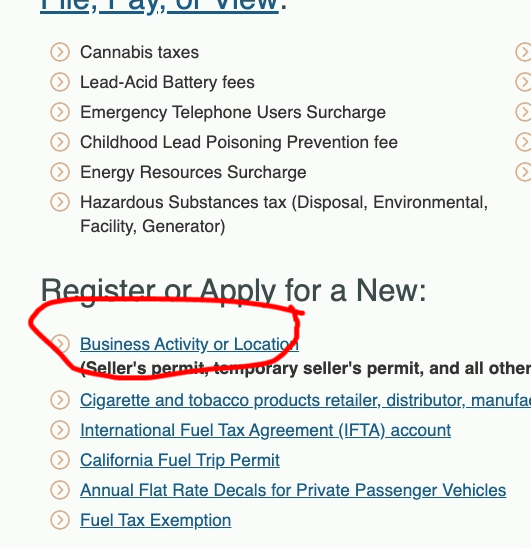

- Click on Business Activity or Location

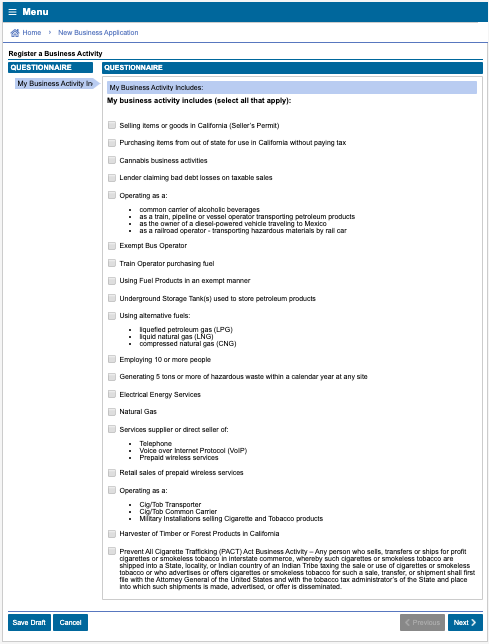

- Form will open, fill the form and submit

First you need to visit ca.gov portal. Click on Doing business link.

Next, link will take you to a page, click on Apply for Sellers Permit.

Next click on Launch Services.

Next you need to click on Business Activity Link.

You will be taken to registration page. You need to fill the complete form to start with registration.

Documents and Information required for Sales Tax Registration in California

- Driver License

- Social Security Number (SSN)

- Email Address

- Supplier Name/Address

- Personal References

- Bookkeeper/Accountant Address and Phone Number (if applicable)

- FEIN (Partnership, Association, Organization, Trust, Estate, Joint Venture, Receivership/Fiduciary, Unincorporated Business Organization, Corporation, Limited Liability Partnership, Limited Partnership, Limited Liability Corporation)

- California Secretary of State Entity Number (Corporation, Limited Liability Partnership, Limited Partnership, Limited Liability Corporation)

- Officer, Member, or Partner Information (date of birth, SSN, or driver license and address)

- Agency Name (Federal, State, and Local Government)

- Contact information of the person(s) who maintains the books and records (name, address and phone number)

Procedure in case of buying a business

If you are buying an already registered and running business in California, you should get a Clearance Certificate for tax authorities. In case you do not get the Clearance Certificate, any unpaid tax liability of existing business will be recovered from you.

Further, if you are resigning from a partnership, you must inform tax authorities to avoid liability incurred after your separation.

Sales Tax Rates in California

| State Rate | 6.00% |

| County Rate | 0.25% |

| City Rate | 0.77% |

| Special Rate | 1.92% |

| Combined Rate | 8.39% |

Check Sales Tax Calculator and Rates in California.

Updated: March 31, 2020

Related Posts

Sales Tax in USAEvery economy to sustain development projects needs sources of funding. Sales tax worldwide has been major contributor for government funding. I...

Sales Tax Registration in Ohio

Every retailer before selling any taxable product has to compulsory take Sales tax registration in Ohio state. Person having nexus in Ohio state an...

Sales Tax Registration in Washington

You will need Business License registration or sales and use tax registration to run your business in Washington state. Business license can be ...

Sales Tax Registration process in New York

Every person making taxable sales has to obtain Certificate of Authority. Certificate of Authority is registration certificate issued by New York t...

Sales Tax Registration in Florida

Florida collects both Sales Tax and Use Tax. Sales tax is charged on any sale, storage or rental, unless the product is exempted from tax. Use t...

Sales Tax Registration Texas

Every entity engaging in trade of products, services have to register under Sales Tax in Texas. Texas has both sales tax and use tax on taxable pro...

Tax system in United States of America

In world 2 types of taxes are levied on citizens, Direct Taxes and Indirect Taxes. Impact of direct tax is born by tax payer and indirect taxes are...