Sales Tax Registration process in New York

Every person making taxable sales has to obtain Certificate of Authority. Certificate of Authority is registration certificate issued by New York tax department.

You can collect sales tax only if you have certificate of authority, after getting COA tax has to be collected by seller from purchasers on every sales made. In case buyer holds certificate of exemption, sales tax is not required to be collected.

Certificate of Authority (COA) has to be displayed at business place all the time. It is recommended to register with state tax department at least 20 prior to start of business.

Documents/Information required for Certificate of Authority

- Reason for applying

- Contact information for the business

- Legal name

- Federal employer ID number

- Business address

- Phone number

- Email address

- Entity Type

- Date you will begin business for sales tax purposes

- Bank account information

- License number(s)

- Tax preparer information

- Business contacts' and responsible persons' information

- Social Security Number

- Effective date of assuming business responsibilities, and primary business duties

Sales Tax Registration Process

- Go to www.tax.ny.gov website

- Click on Register for Sales Tax

- Click on Apply Online

- Login or Register on portal

- Apply for Sales Tax (Certificate of Authority)

The first step is to visit New York state tax website. Once you are on website click on Register for Sales Tax link.

The above link will take you to instruction and requirement page. Here click on Apply Now.

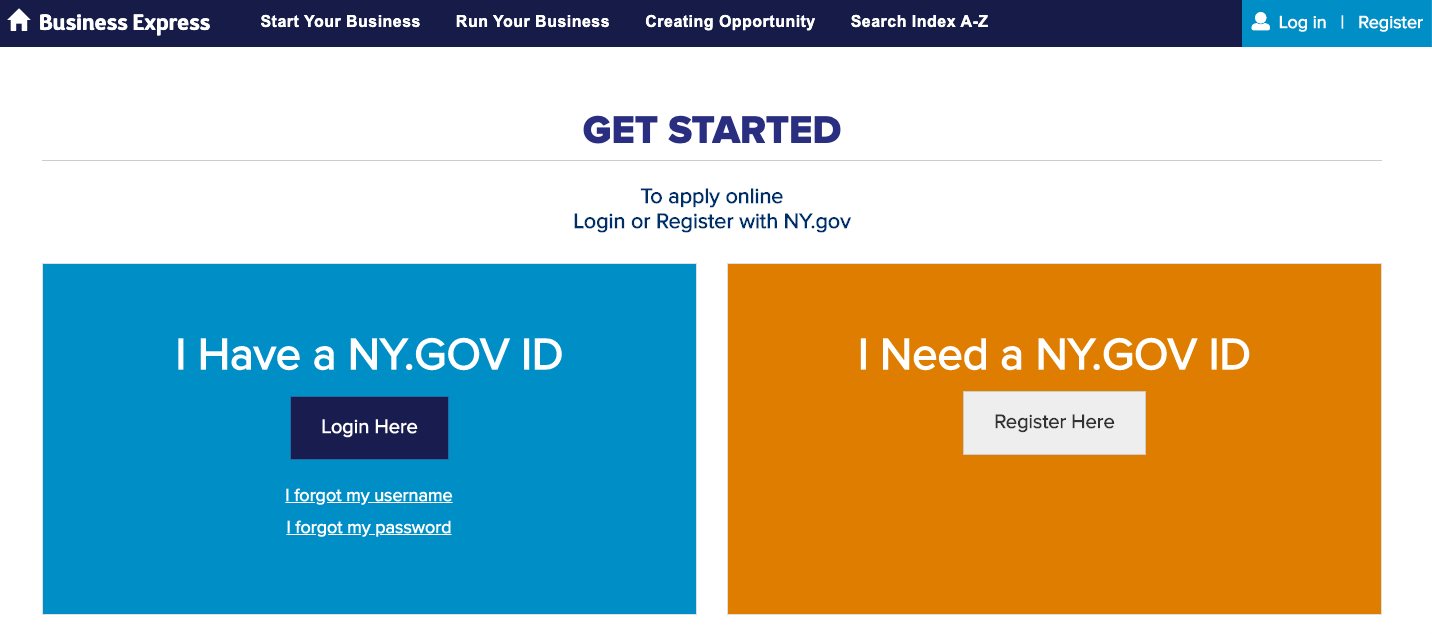

This will take you to login and registration page of businessexpress portal of New York state. If you already have login id for ny.gov portal then click on login or click on register.

After creating account or login, you can apply for sales tax registration.

Steps in applying for Certificate of Authority (sales tax registration) are:

- Reason for applying

- Business Activity

- Nature of entity

- Address and contact details

- SSN details and other documentary details

Once your registration is complete, you will receive COA through mail.

Sales Tax Rates in New York

| State Rate | 4.00% |

| County Rate | 3.99% |

| City Rate | 4.46% |

| Special Rate | 0.38% |

| Combined Rate | 8.19% |

Check Sales Tax calculator and rates in New York.

Updated: March 31, 2020

Related Posts

Sales Tax in USAEvery economy to sustain development projects needs sources of funding. Sales tax worldwide has been major contributor for government funding. I...

Sales Tax Registration in Ohio

Every retailer before selling any taxable product has to compulsory take Sales tax registration in Ohio state. Person having nexus in Ohio state an...

Sales Tax Registration in Washington

You will need Business License registration or sales and use tax registration to run your business in Washington state. Business license can be ...

Sales Tax Registration in Florida

Florida collects both Sales Tax and Use Tax. Sales tax is charged on any sale, storage or rental, unless the product is exempted from tax. Use t...

Sales Tax Registration Texas

Every entity engaging in trade of products, services have to register under Sales Tax in Texas. Texas has both sales tax and use tax on taxable pro...

Sales Tax Registration in California

Sales and Use tax are applicable in state of California. If you are seller here or have nexus then you are required to have sales tax per...

Tax system in United States of America

In world 2 types of taxes are levied on citizens, Direct Taxes and Indirect Taxes. Impact of direct tax is born by tax payer and indirect taxes are...