Sales Tax Registration in Florida

Florida collects both Sales Tax and Use Tax. Sales tax is charged on any sale, storage or rental, unless the product is exempted from tax.

Use tax is charged on usage or consumption of taxable products or services on which sales tax is not paid.

Florida has both online and offline options for getting Sales Tax Permit in state. Online method is preferred as it is faster route to get your sales tax permit.

We will explain online procedure to get sales tax permit, for offline procedure you need to fill and submit form DR-1 to your local tax department.

Documents and information required for Sales Tax Permit in Florida

- Legal Entity Type

- Legal Name of Entity

- Federal EIN

- Date of Organization FYE**, Charter Number

- Owner or Officer Name(s)

- Owner or Officer SSN

- Owner’s Address

- Owner’s Telephone Number

- Business Physical Address

- Signature of Owner or Officer

Sales Tax Registration Procedure

You have online facility to obtain sales tax permit in Florida. It is very easy to get sales tax permit if you read and understand requirements before applying.

Before applying for sales tax permit, make sure you have documents and information ready.

- taxapps.floridarevenue.com/IRegistration/

- Provide Reason for registration

- Select business activities

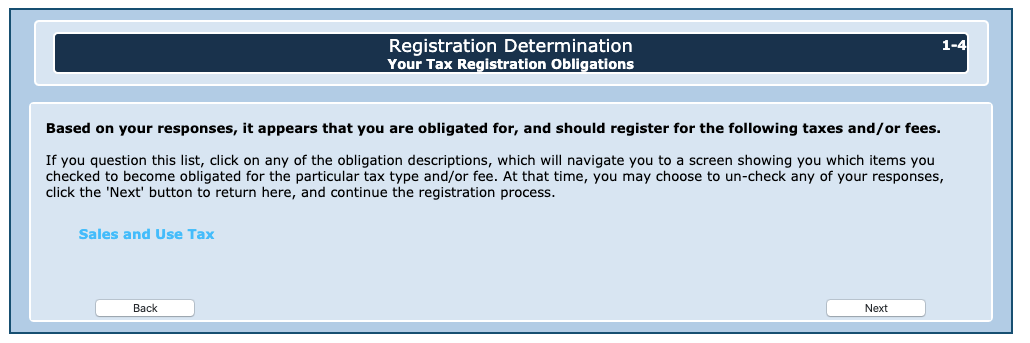

- Based on above selections, obligation to registration will be shown

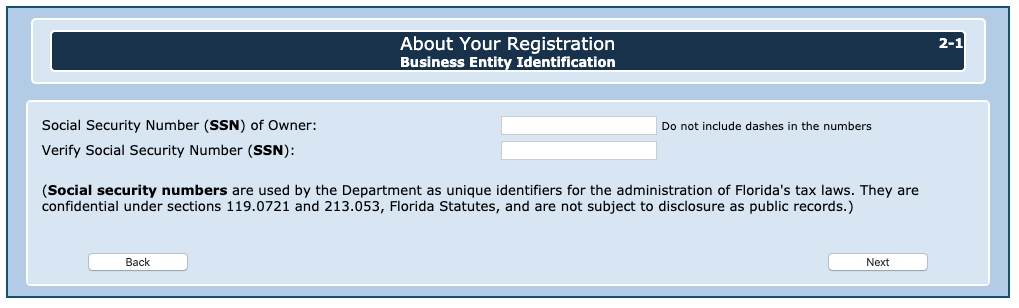

- Provide entity identification (SSN)

- Click Next and complete application

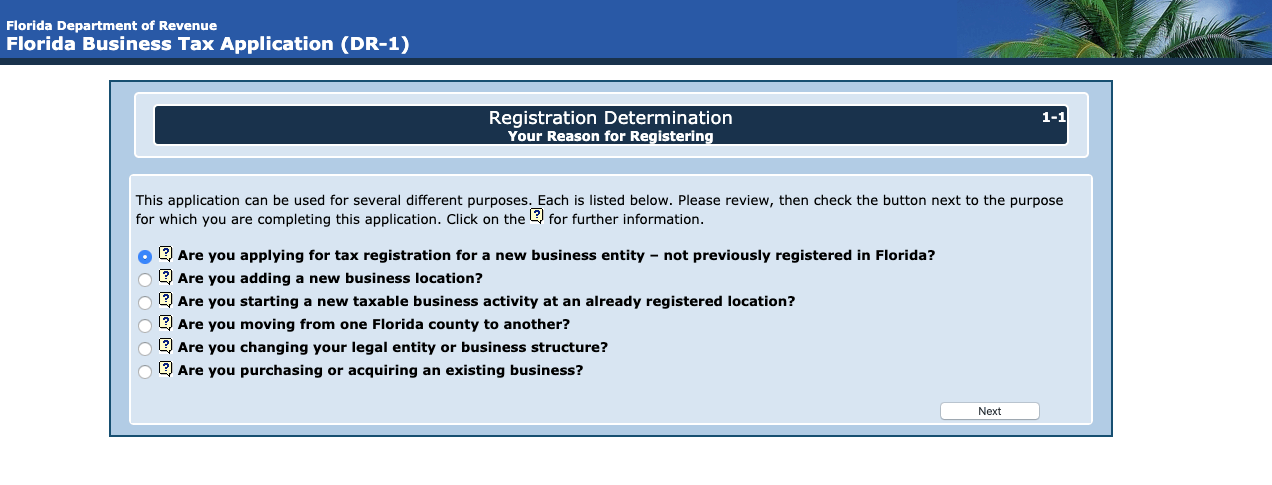

Reason for registering

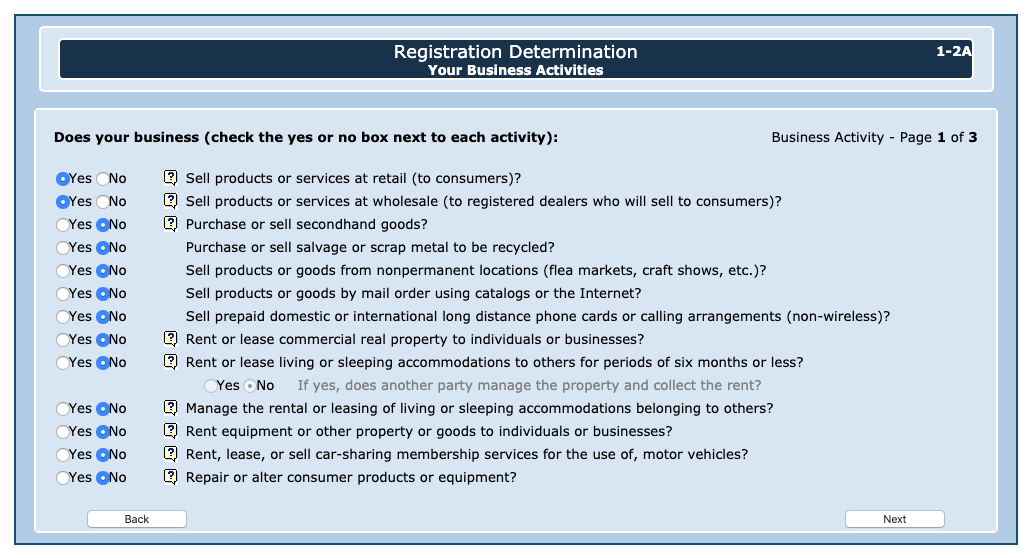

Business Activity

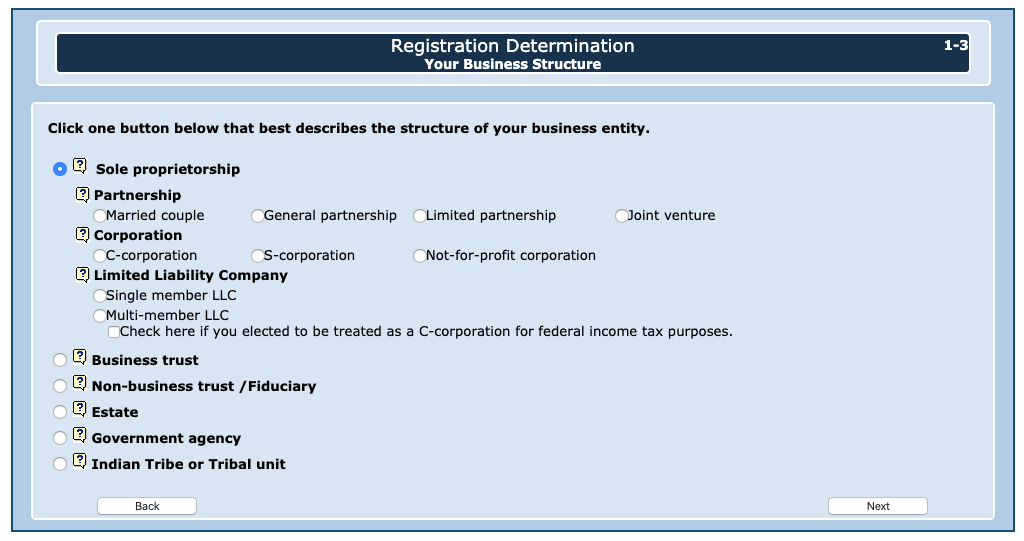

Business Structure

Registration obligation

Entity identification

This is a single form and window to obtain sales tax permit in Florida. You can visit and complete registration formality on your own without spending on a consultant.

Further registration is required by all type of entities whether you are Business Trust, Corporation, Estate, General Partnership, Indian Tribe/Tribal Unit, Limited Partnership, Married Couple, Multi-Member LLC, Non-Business Trust, Single Member LLC or Sole Proprietor.

Returns and Tax

After registration you have to comply with tax payment and return filing requirements. Due to pay and file return is 20th of each month. If due date falls on holiday then due date will be next working day.

Return has to be filed (NIL return) even if their is not transaction during the month.

Return and payment can be made on state filing portal.

| Annual Sales Tax | Due date |

|---|---|

| More than $1,000 | Monthly |

| $501 - $1,000 | Quarterly |

| $101 - $500 | Semiannual |

| $100 or less | Annual |

Sales Tax Rates in Florida

| State Rate | 6.00% |

| County Rate | 1.06% |

| City Rate | 0.00% |

| Special Rate | 0.00% |

| Combined Rate | 7.05% |

Check Sales Tax Calculator and rates in Florida.

Updated: March 31, 2020

Related Posts

Sales Tax in USAEvery economy to sustain development projects needs sources of funding. Sales tax worldwide has been major contributor for government funding. I...

Sales Tax Registration in Ohio

Every retailer before selling any taxable product has to compulsory take Sales tax registration in Ohio state. Person having nexus in Ohio state an...

Sales Tax Registration in Washington

You will need Business License registration or sales and use tax registration to run your business in Washington state. Business license can be ...

Sales Tax Registration process in New York

Every person making taxable sales has to obtain Certificate of Authority. Certificate of Authority is registration certificate issued by New York t...

Sales Tax Registration Texas

Every entity engaging in trade of products, services have to register under Sales Tax in Texas. Texas has both sales tax and use tax on taxable pro...

Sales Tax Registration in California

Sales and Use tax are applicable in state of California. If you are seller here or have nexus then you are required to have sales tax per...

Tax system in United States of America

In world 2 types of taxes are levied on citizens, Direct Taxes and Indirect Taxes. Impact of direct tax is born by tax payer and indirect taxes are...